Recently, my son asked me why I choose to invest in certain companies over others. It made me reflect on how much my approach is shaped by the wisdom of legendary investors. Today, I want to share what I’ve learned from one of the greatest—Warren Buffett. If you’re curious about how to evaluate companies and make smart investment choices, this is a great place to begin.

"I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years." - Warren Buffett

When Warren Buffett picks a stock, he sits down with a company's financial statements and reads them like a detective novel, searching for clues about the business's true health and future prospects. Today, we're going to learn how to do exactly that.

Let's dive into a real financial statement and decode it line by line, transforming what looks like accounting gibberish into a compelling business story.

Meet Our Mystery Company

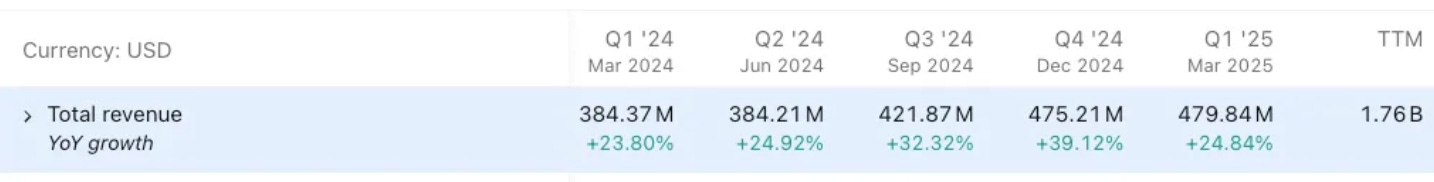

We’re looking at five quarters of financial data from Q1 2024 through Q1 2025. Think of this as a company's report card, showing us exactly how they performed each quarter. But unlike a school report card with simple letter grades, this one tells us a complex story about money coming in, money going out, and what's left over.

The Revenue Story: Following the Money Trail

Total Revenue: The Company's Heartbeat

Let's start with the most important number: revenue. This is simply all the money customers paid the company for its products or services.

Keep reading with a 7-day free trial

Subscribe to More Work More Play to keep reading this post and get 7 days of free access to the full post archives.